Absolutely. Let’s craft a comprehensive 3000-word article about investing in Niron Magnetics, focusing on clarity and actionable insights.

The world is undergoing a significant shift towards sustainable technologies, and at the heart of this transformation lies the need for powerful, efficient, and ethically sourced magnets. Traditional rare-earth magnets, while potent, are plagued by supply chain vulnerabilities and environmental concerns. Enter Niron Magnetics, a company pioneering the development of high-performance, rare-earth-free magnets. This article delves into the intricacies of Niron Magnetics, exploring its technology, market potential, investment considerations, and the risks and rewards associated with backing this innovative company.

Rare-earth magnets, primarily neodymium iron boron (NdFeB), are crucial components in electric vehicles (EVs), wind turbines, and numerous other high-tech applications. However, their reliance on rare-earth elements, largely mined and processed in China, creates significant geopolitical and environmental risks.

Supply Chain Vulnerability: The concentration of rare-earth production in a single region exposes industries to potential disruptions and price volatility.

These challenges have spurred a global search for alternative magnet technologies, and Niron Magnetics is at the forefront of this endeavor.

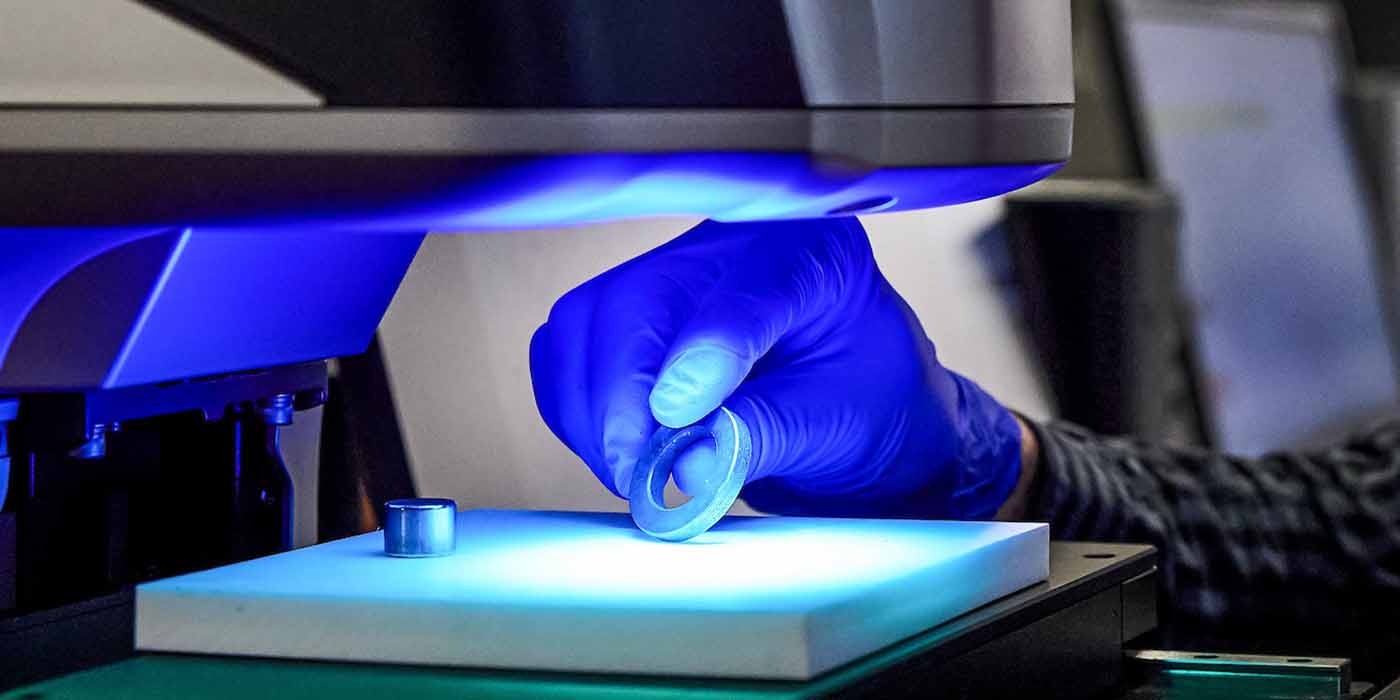

Niron Magnetics is developing high-performance magnets based on iron nitride (Fe16N2), a material with the potential to surpass the performance of traditional rare-earth magnets.

Abundant Materials: Iron and nitrogen are readily available and abundant, reducing reliance on scarce rare-earth elements.

Niron’s technology focuses on creating a high-purity iron nitride powder and then consolidating it into high-performance magnets. Their proprietary process addresses the historical challenges of producing stable and high-quality iron nitride materials.

The market for high-performance magnets is rapidly expanding, driven by the growth of EVs, renewable energy, and other clean technologies.

Electric Vehicles

The EV market is booming, and electric motors rely heavily on high-performance magnets.

Wind Turbines

Wind energy is a critical component of the global transition to renewable energy.

Consumer Electronics and Industrial Applications

Magnets are used in a wide range of consumer electronics, including smartphones and laptops.

Investing in Niron Magnetics presents both opportunities and risks. Here are some key considerations for potential investors:

Technology Validation and Scalability

Niron’s technology is still in the development and scaling phase.

Competition and Market Adoption

Niron faces competition from established rare-earth magnet manufacturers and other companies developing alternative magnet technologies.

Financial Performance and Funding

As a pre-revenue company, Niron relies on venture capital and other forms of funding.

Intellectual Property and Patents

Niron’s intellectual property, including patents and proprietary manufacturing processes, is a key asset.

Management Team and Expertise

The quality and experience of Niron’s management team are crucial for its success.

Investing in early-stage technology companies like Niron Magnetics involves inherent risks.

Risks

Technological Uncertainty: The technology may not perform as expected or may face unforeseen challenges.

Rewards

High Growth Potential: If successful, Niron could capture a significant share of the rapidly growing magnet market.

Before investing in Niron Magnetics, thorough due diligence is essential.

Review Company Documents

Assess Technology and Patents

Evaluate the technical feasibility and competitive advantage of Niron’s technology.

Analyze Market Potential

Evaluate Management Team

Consider Investment Risks

Niron Magnetics represents a promising opportunity to invest in the future of sustainable magnet technology. By developing high-performance, rare-earth-free magnets, Niron has the potential to address critical supply chain and environmental challenges. While investing in early-stage companies involves risks, the potential rewards and positive impact make Niron a compelling opportunity for forward-thinking investors.

By carefully considering the technology, market potential, investment considerations, and risks and rewards, investors can make informed decisions about whether to support Niron Magnetics in its mission to revolutionize the magnet industry. The journey of Niron Magnetics is one that many in the technology and investing community will be watching closely.