Absolutely! Crafting a 3000-word article on investing in coffee is a fascinating endeavor. Here’s a comprehensive guide, structured with `

` and `

` tags for clarity:

Coffee, the world’s second most traded commodity after oil, presents a unique investment opportunity. From the bustling cafes of New York to the sprawling plantations of Brazil, coffee’s influence is undeniable. Understanding the nuances of this market is crucial for investors seeking to capitalize on its potential. This guide will explore various avenues for investing in coffee, from futures contracts to publicly traded companies and beyond.

Understanding the Coffee Market

The Global Coffee Landscape

The coffee market is a complex ecosystem, influenced by factors ranging from weather patterns to geopolitical events. The two primary coffee varieties, Arabica and Robusta, each have distinct characteristics and market dynamics. Arabica, known for its superior flavor, commands a premium price, while Robusta, used primarily in instant coffee and blends, is more resilient and cost-effective.

Supply and Demand Dynamics

Understanding the balance between supply and demand is fundamental to successful coffee investing. Supply is influenced by factors such as:

Weather: Frost, drought, and excessive rainfall can significantly impact crop yields.

Demand is driven by:

Global Consumption: Rising disposable incomes in emerging markets are driving increased coffee consumption.

Factors That effect pricing.

Currency Exchange Rates: Because much coffee trading is done in U.S. Dollars, Currency exchange rates effect profits.

Investment Strategies

Futures Contracts

Coffee futures contracts, traded on exchanges like the Intercontinental Exchange (ICE), allow investors to speculate on future coffee prices. This strategy offers high leverage but also carries significant risk.

Pros:

Investing in Coffee Companies

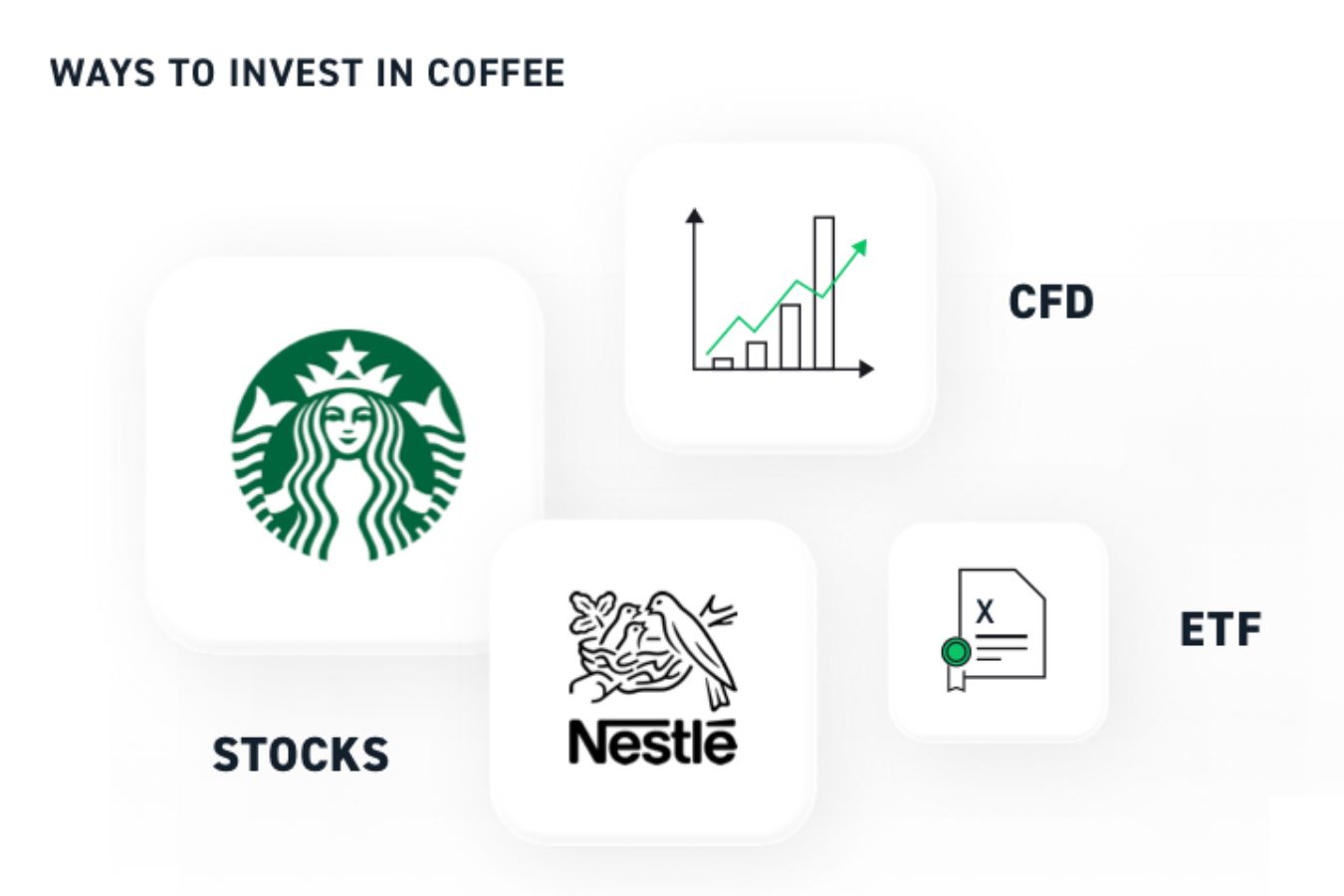

Investing in publicly traded companies involved in the coffee supply chain is another avenue. This includes:

Producers: Companies that own and operate coffee plantations.

Exchange-Traded Funds (ETFs) and Exchange-Traded Notes (ETNs)

ETFs and ETNs offer a diversified approach to coffee investing. These funds track indices of coffee futures or coffee-related companies, providing exposure to the market without the need to manage individual futures contracts.

Pros:

Investing in Specialty Coffee

The specialty coffee market, characterized by high-quality beans and unique flavor profiles, is experiencing rapid growth. Investing in this segment can include:

Direct Trade: Purchasing coffee directly from farmers, supporting sustainable and ethical practices.

Direct Investment in Coffee Farms

For those seeking a more hands-on approach, direct investment in coffee farms is an option. This requires significant capital and expertise but can offer substantial returns.

Pros:

Risk Management

Market Volatility

The coffee market is inherently volatile, subject to sudden price swings. Investors must implement risk management strategies, such as:

Diversification: Spreading investments across different coffee-related assets.

Weather-Related Risks

Weather patterns can significantly impact coffee production, leading to supply disruptions and price volatility.

Monitoring weather forecasts: staying updated on potential weather conditions in key coffe growing regions.

Political and Economic Risks

Political instability and economic downturns in coffee-producing regions can impact production and trade.

Due diligence: researching political and economic stability within coffee producing regions.

The Future of Coffee Investing

Sustainable and Ethical Coffee

Increasingly, consumers are demanding sustainable and ethically sourced coffee. Investors who prioritize these values can capitalize on the growing demand for responsible coffee production.

Technological Advancements

Technological advancements, such as precision agriculture and blockchain technology, are transforming the coffee industry. These innovations can improve efficiency, transparency, and traceability, creating new investment opportunities.

Climate Change Impacts

Climate change poses a significant threat to coffee production, with rising temperatures and changing rainfall patterns impacting crop yields. Investors must consider these long-term risks and support sustainable practices.

Investing in coffee offers a unique blend of potential rewards and risks. By understanding the market dynamics, implementing sound investment strategies, and managing risks effectively, investors can capitalize on the opportunities presented by this global commodity.